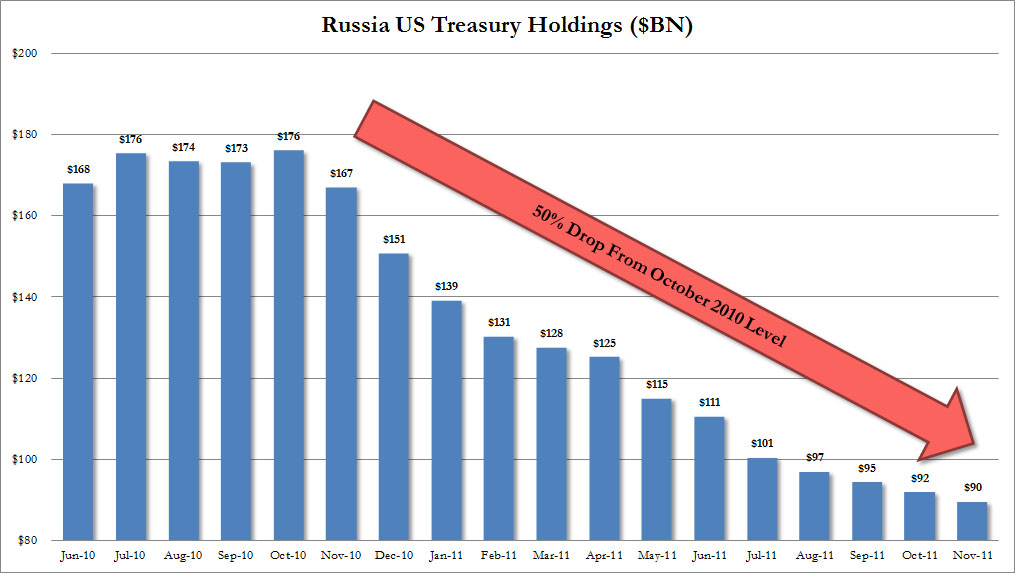

Russia has dropped its holdings of U.S. Treasuries over the past 14 months to $88.4 billion. Russia’s investment in U.S. Treasuries started to decline beginning October 2010. In December 2011, this investment fell to $88.4 billion from $89.7 billion in November, registering a 49.86 percent decrease over the 14-month period. This decrease will continue until the dollar is at a reasonable range to control the impact it will have when it collapses…

This is in line with what Russia said they would do as to the need to get out from under the US dollar. This is no surprise but we should understand that not only is Russia doing this, but many other countries are slowly dropping their holdings of the US dollar…

Side news: China remained the main buyer of U.S. Treasuries in December 2011, although its investment dropped to $1,100.7 billion from $1,132.6 billion in November. It was followed by Japan dropping with $1,042.4 billion and Great Britain dropping with $414.8 billion…

A fast drop would collapse the dollar too fast! It is a fact that one day when all those dollars floating around the world, get sent back home (to USA) by all or any means. That is when you will see a big big issue develop. The dollar only survives because it is being held afloat by so many countries that use it for transactions. Those countries are now in the process of changing what they hold as currency. But they do it slowly but surely…

Time to think people…

Kyle Keeton

Windows to Russia!